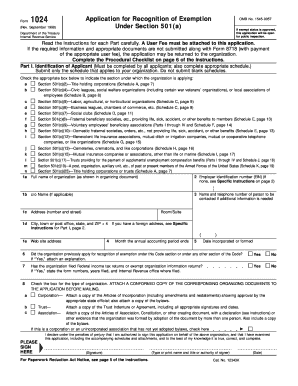

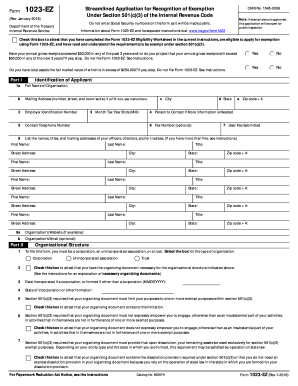

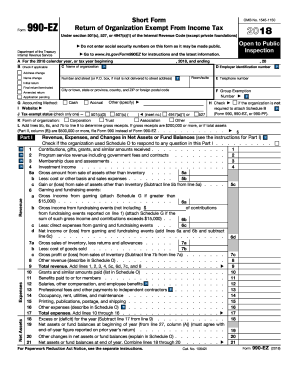

IRS 1024 2018-2026 free printable template

Instructions and Help about IRS 1024

How to edit IRS 1024

How to fill out IRS 1024

Latest updates to IRS 1024

All You Need to Know About IRS 1024

What is IRS 1024?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1024

What should I do if I realize I made a mistake on my filed IRS 1024?

If you discover an error after submitting your IRS 1024, you can file an amended version of the form. Use IRS Form 1024-A to correct the original submission and provide a detailed explanation of the changes. This helps ensure that your corrections are clear and properly documented.

How can I check the status of my IRS 1024 submission?

To verify the receipt and processing of your IRS 1024, you can contact the IRS directly or utilize their online tracking tools, if available. Keep in mind that e-file rejections often come with specific codes that indicate the problem; understanding these can expedite the resolution process.

What are some common errors I should avoid when submitting the IRS 1024?

Common errors in filing the IRS 1024 include inaccuracies in identifying information like the taxpayer identification number or outdated organizational details. Ensuring that all information matches IRS records can help avoid unnecessary processing delays and potential rejections.

Can I use e-signatures when submitting the IRS 1024?

Yes, e-signatures are generally accepted for IRS 1024 submissions, provided they meet certain IRS standards for authenticity. It's essential to ensure that the e-signature complies with the IRS guidelines to prevent complications during the filing process.

What should I do if I receive a notice regarding my IRS 1024 submission?

If you receive a notice from the IRS concerning your IRS 1024, carefully review the contents for specific instructions. Prepare any required documentation and respond promptly to avoid further complications, ensuring you keep copies of both the notice and your response for your records.

See what our users say